Employee paycheck calculator

Process Payroll Faster Easier With ADP Payroll. Federal Salary Paycheck Calculator.

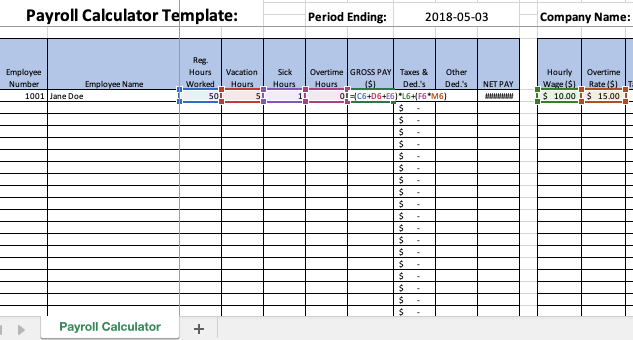

Payroll Calculator Free Employee Payroll Template For Excel

Start setting up Gusto for free and dont pay a cent until youre ready to run payroll.

. Ad Compare This Years Top 5 Free Payroll Software. Time and attendance software with project tracking to help you be more efficient. We use the most recent and accurate information.

We designed a calculator that makes it easy to run an off-cycle paycheck for departing employees and meet your federal and state. Get 3 Months Free Payroll. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Ad No more forgotten entries inaccurate payroll or broken hearts. Free Unbiased Reviews Top Picks. In other words the total ERC you can claim is 5000 per employee per.

If payroll is too time consuming for you to handle were here to help you out. Process Payroll Faster Easier With ADP Payroll. Ad Manage payroll benefits onboarding and compliance with Gustos all-in-one platform.

Important Note on Calculator. Get Started With ADP Payroll. California government employees who withhold federal income tax.

Exempt means the employee does not receive overtime pay. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. HRA received It refers to the actual amount of house rent.

If calculating final pay sounds daunting dont worry. The maximum an employee will pay in 2022 is 911400. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Ad No more forgotten entries inaccurate payroll or broken hearts. When you choose SurePayroll to handle your small business payroll. The qualified wages limit is 10000 per employee per year and you can take up to 50 of that amount.

It comprises the following components. Components of Payroll Tax. Hourly Paycheck and Payroll Calculator.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Ad Calculate Your Payroll With ADP Payroll. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Time and attendance software with project tracking to help you be more efficient. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Important Note on the Hourly Paycheck Calculator. 686 form to reflect the redesign.

Subtract any deductions and. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

We hope these calculators are useful to you. 17 rows The State Controllers Office has updated the Employee Action Request STD. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

In addition to this our Paycheck Tracker has a dashboard to see cumulative earnings as well. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees.

The basic salary for HRA calculation is estimated by adding basic salary dearness allowance and sales commission. Start setting up Gusto for free and dont pay a cent until youre ready to run payroll. By accurately inputting federal withholdings allowances and any relevant.

This number is the gross pay per pay period. In a few easy steps you can create your own paystubs and have them sent to your email. Ad Calculate Your Payroll With ADP Payroll.

Plug in the amount of money youd like to take home. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Need help calculating paychecks.

Ad Manage payroll benefits onboarding and compliance with Gustos all-in-one platform. This component of the Payroll tax is withheld and forms a revenue source for the Federal. Get Started With ADP Payroll.

This Payroll Calculator Excel Template supports as many employees as you want. Ad Create professional looking paystubs. Free salary hourly and more paycheck calculators.

Get an accurate picture of the employees gross pay. To try it out enter the. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Get 3 Months Free Payroll. Your employer withholds a 62 Social Security tax and a.

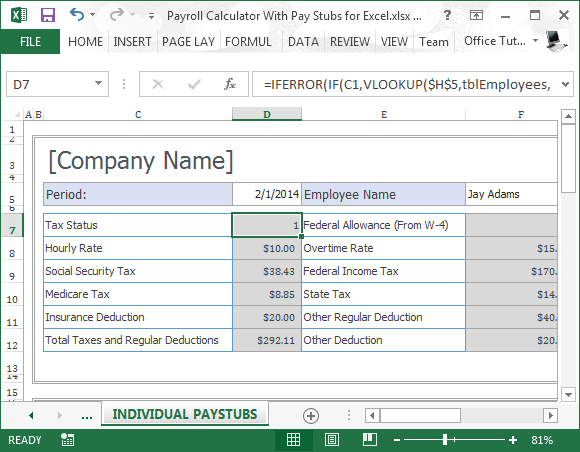

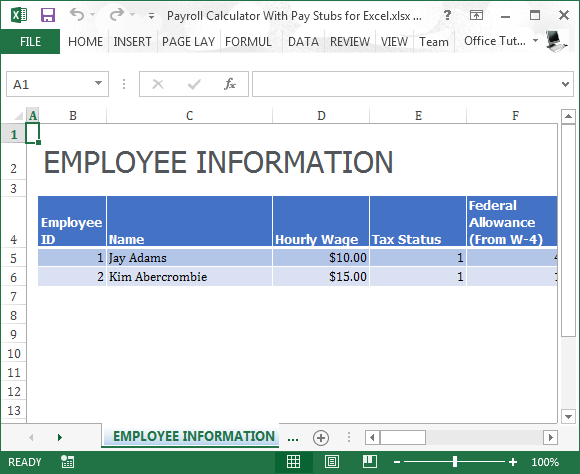

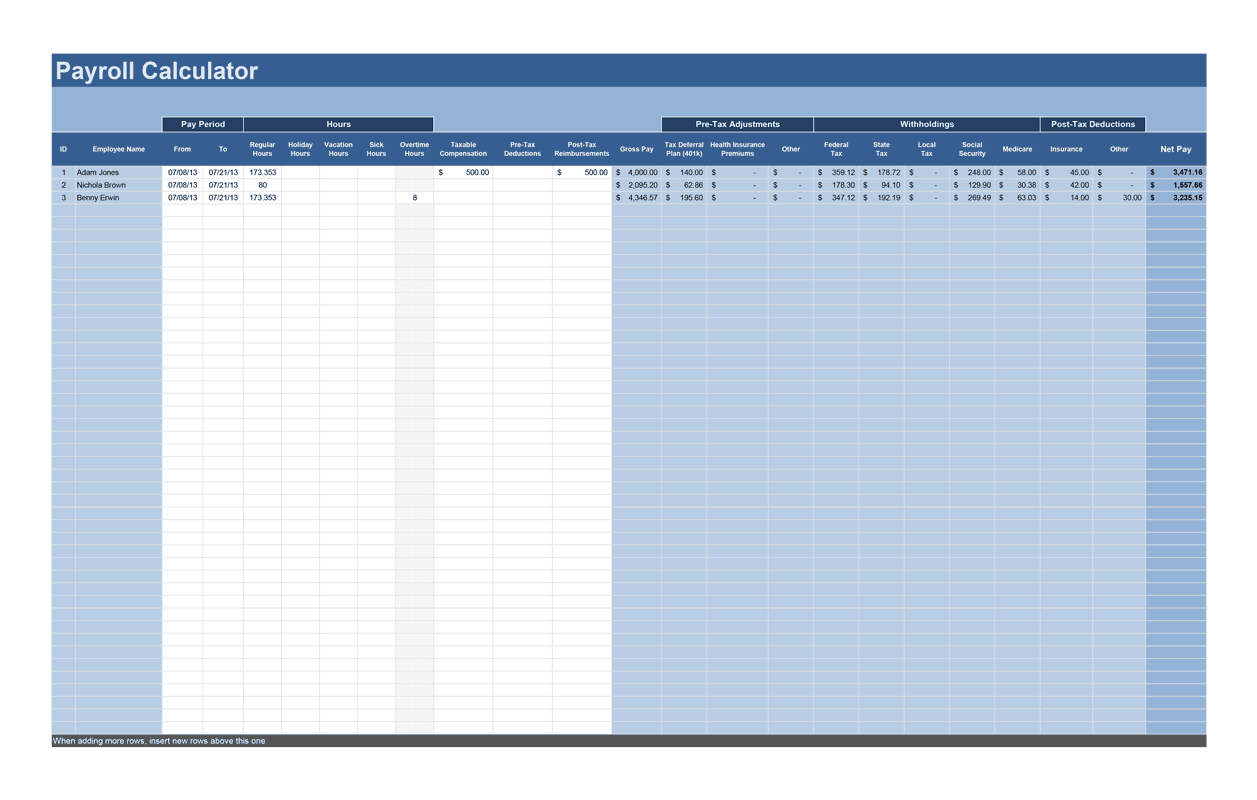

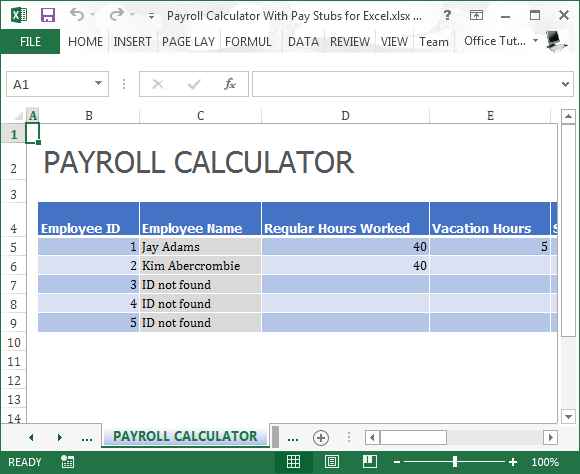

Payroll Calculator With Pay Stubs For Excel

Bi Weekly Timecard Calculator With Lunch Break Wages And Ot

Payroll Calculator Free Employee Payroll Template For Excel

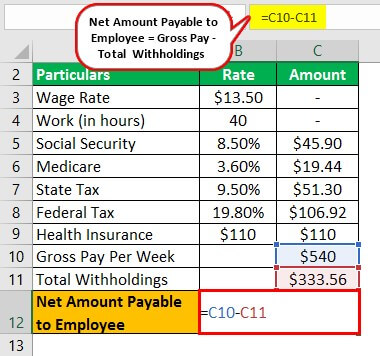

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Take Home Pay Calculator

Payroll Formula Step By Step Calculation With Examples

Free Payroll Tax Paycheck Calculator Youtube

Payroll Template Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

1wxmydejhzto9m

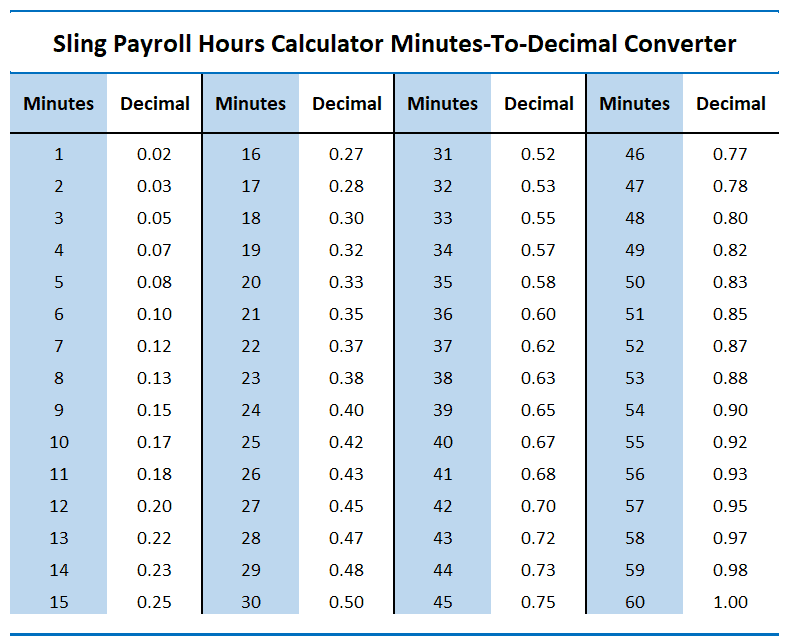

How To Calculate Payroll For Hourly Employees Sling

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator Take Home Pay Calculator

Excel Payroll Formulas Includes Free Excel Payroll Template

Payroll Calculator With Pay Stubs For Excel